INTRODUCTION

Royal Sundaram Lifeline, a health insurance plan designed to provide comprehensive coverage, peace of mind, and financial protection in the face of medical uncertainties. Let’s dive into what makes Royal Sundaram Lifeline a standout choice in the crowded health insurance market.

What is Royal Sundaram Lifeline?

Royal Sundaram Lifeline is a health insurance plan offered by Royal Sundaram General Insurance Co. Ltd., one of India’s leading insurance providers. The Lifeline series is tailored to cater to the diverse health insurance needs of individuals and families, offering extensive coverage options and a host of additional benefits that make it a preferred choice for many.

Key Features of Royal Sundaram Lifeline

1. Comprehensive Coverage

One of the most appealing aspects of Royal Sundaram Lifeline is its broad coverage. The plan covers hospitalization expenses, pre and post-hospitalization costs, daycare procedures, and even alternative treatments like Ayurveda, Unani, Siddha, and Homeopathy (AYUSH).

2. No Room Rent Limit

Many health insurance policies impose a limit on room rent, which can be a significant concern during hospital stays. With Royal Sundaram Lifeline, there are no such limits, allowing policyholders to choose any hospital room without worrying about additional expenses.

3. Lifetime Renewability

Royal Sundaram Lifeline offers lifetime renewability, ensuring that policyholders can continue to enjoy the benefits of their health insurance plan throughout their lives without the risk of losing coverage as they age.

4. No Claim Bonus

For every claim-free year, policyholders are rewarded with a No Claim Bonus (NCB), which increases the sum insured without any additional premium. This can significantly boost the coverage amount over the years, providing added protection without extra cost.

5. Health and Wellness Benefits

The Lifeline plan goes beyond traditional health insurance by including health and wellness benefits. Policyholders can access annual health check-ups, second opinion services, and wellness programs that promote a healthier lifestyle.

Coverage Options

Royal Sundaram Lifeline offers three variants to suit different needs and budgets:

1. Lifeline Classic

This is the basic variant, providing essential health insurance coverage at an affordable premium. It includes benefits like inpatient hospitalization, pre and post-hospitalization expenses, and a No Claim Bonus.

2. Lifeline Supreme

A step up from the Classic variant, Lifeline Supreme offers enhanced coverage and additional benefits such as coverage for maternity expenses, vaccination for newborns, and a higher No Claim Bonus.

3. Lifeline Elite

The Elite variant is the most comprehensive option, designed for those seeking maximum coverage and benefits. It includes features like worldwide emergency hospitalization, coverage for organ donor expenses, and an even higher No Claim Bonus, among others.

Additional Benefits

1. Emergency Domestic Evacuation

In case of a medical emergency, Lifeline covers the cost of transporting the insured to the nearest hospital, ensuring timely and efficient medical care.

2. Second Opinion for Critical Illness

For policyholders diagnosed with critical illnesses, Royal Sundaram Lifeline offers a second opinion service from a panel of medical experts, providing reassurance and additional guidance on treatment options.

3. Restoration of Sum Insured

If the sum insured is exhausted during the policy period, Lifeline offers automatic restoration of up to 100% of the sum insured for unrelated illnesses or injuries, ensuring continuous coverage.

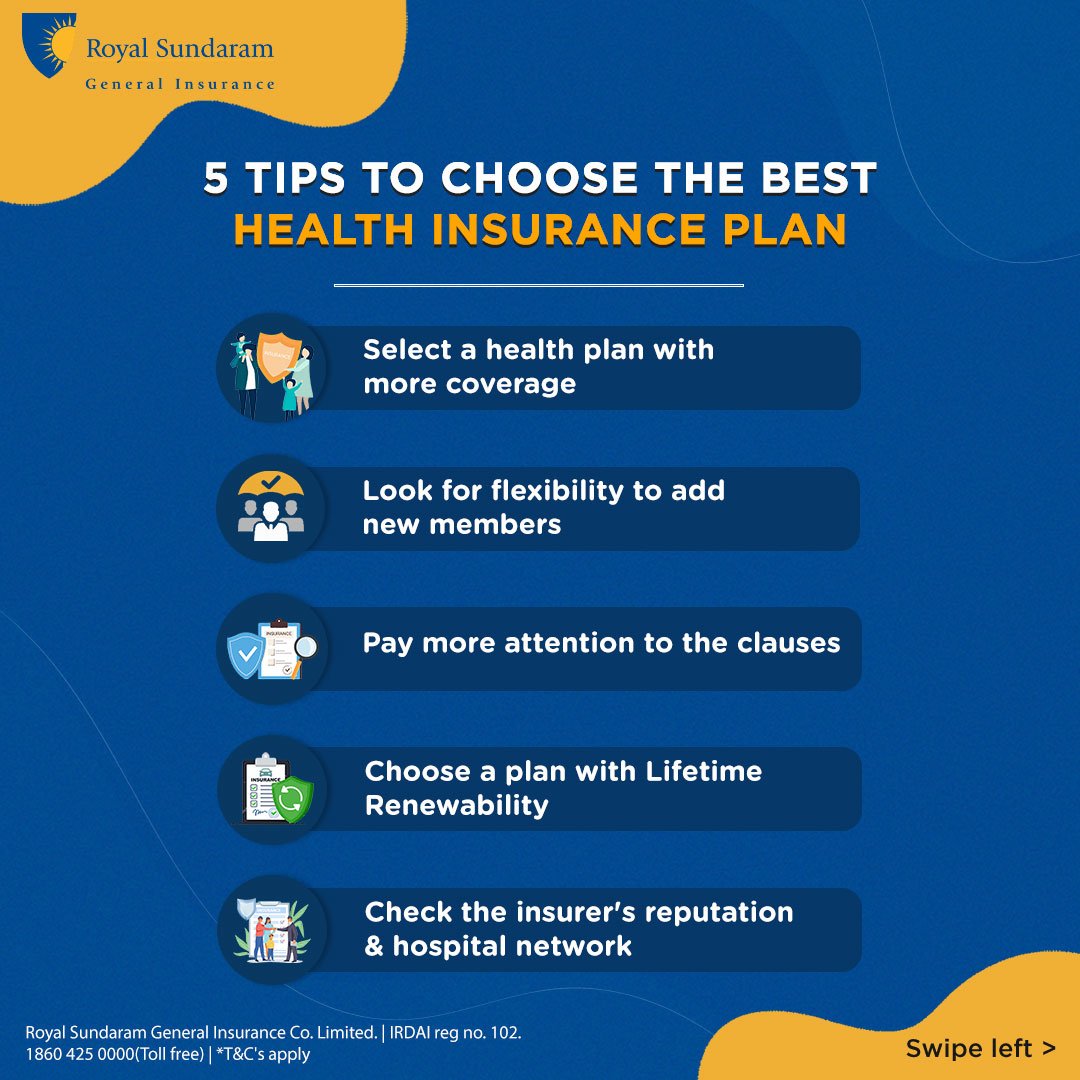

Why Choose Royal Sundaram Lifeline?

Choosing the right health insurance plan is crucial for safeguarding your health and financial well-being. Royal Sundaram Lifeline stands out for its comprehensive coverage, flexible options, and customer-centric benefits. Whether you are looking for basic health insurance or a plan with extensive coverage and added perks, Lifeline has a solution to match your needs.

Conclusion

In a world where medical costs are rising, having a reliable health insurance plan like Royal Sundaram Lifeline can provide invaluable peace of mind. By offering extensive coverage, lifetime renewability, and a plethora of additional benefits, Lifeline ensures that you and your loved ones are protected against the financial burden of medical emergencies.